Guaranteed Minimum Income and Economic Security in The Second Gilded Age

Part I (1791 - 1945) • Part II (1946 - 1975) • Part III (1976 - 2025)

Sanders Marble – PhD History, 1998, King's College London

As part of the Alaska Statehood Act of 1959, Alaska received 100 million acres of land from the federal government. Whatever resources were on - or under - that land would belong to the state and not a federal agency. In the late 1960s, vast oil reserves were discovered on this land. On a single day, September 10, 1969, the state of Alaska realized $900 million when it sold leases on its land for oil production. The oil crisis of 1973 raised oil prices, creating a windfall for Alaska and offered the state, with its vast oil reserves, a unique opportunity to create a true universal Guaranteed Minimum Income (GMI) program – one which still operates today.

However, the rapid expenditure of these funds in a vast, remote state where the provision of public services is expensive caused a public outcry. The Alaska Permanent Fund was established in 1976 as a response to this outcry – a state-managed resource endowment funded by a percentage of profits generated by sales from Alaskan oil and mining revenues. While originally conceived of as a “rainy day” fund, it gained more popular support as a “Permanent Fund Dividend”.

Since 1982, all Alaskan residents have received an annual payment from this fund. The dividend has averaged $1,600/year and is universally popular. (As a comparison, the Federal government calculates a family of 4 needs an income of just over $32,000 to avoid poverty.) Only 16% of Alaskans supported a 1999 measure to use some of the fund for state budget shortfalls. This program is essentially what Thomas Paine and Henry George originally envisioned – compensating citizens for allowing large landowners (or companies) to realize profits from vast amounts of public lands. The annual check is significant, but $1,600/year is difficult to live on, especially since Alaska has one of the highest costs of living of all states due to its remoteness.

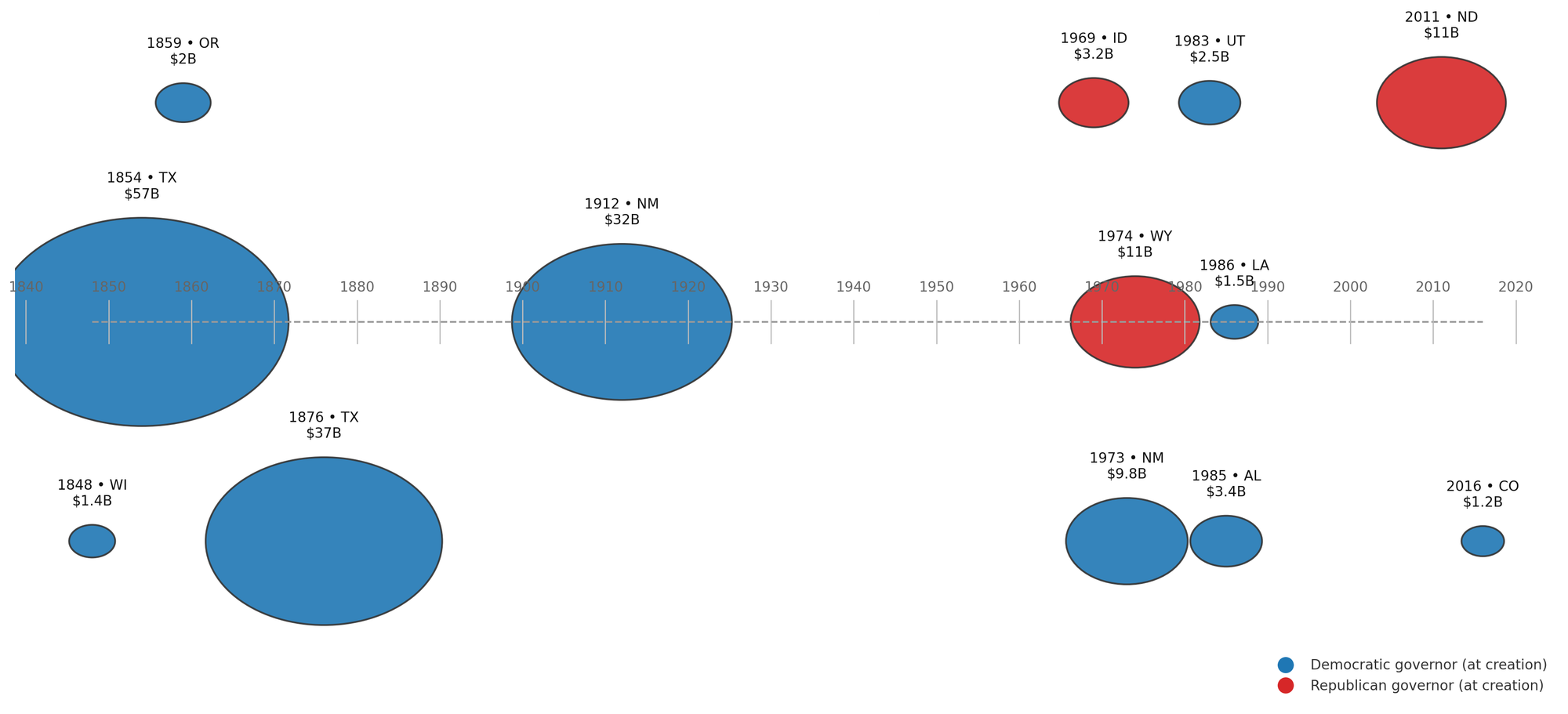

The Alaska Permanent Fund, at $81 billion, is the largest and only fund that pays out a citizen’s dividend. Several other states have sizable natural resource based sovereign wealth funds that provide financial resources for education or act as a “rainy day” fund to address state budget shortfalls. These certainly help the people, but less directly than Alaska's "dividend".

- Wisconsin Board of Commissioners of Public Lands: $1.4 billion (1848)

- Texas Permanent School Fund: $57 billion (since 1854)

- Oregon Common School Fund: $2 billion (1859)

- Texas Permanent University Fund: $37 billion (1876)

- New Mexico Land Grant Permanent Fund: $32 billion (1912)

- Idaho Endowment Fund Investment Board: $3.2 billion (1969)

- New Mexico Severance Tax Permanent Fund: $9.8 billion (1973)

- Permanent Wyoming Mineral Trust Fund: $11 billion (1974)

- Utah School and Institutional Trust Funds Office: $2.5 billion (1983)

- Alabama Trust Fund: $3.4 billion (1985)

- Louisiana Education Quality Trust Fund: $1.5 billion (1986)

- North Dakota Legacy Fund: $11 billion (2011)

- Colorado Public School Fund Endowment Board: $1.2 billion (2016)

Subsequently, both Republican President Donald Trump and Democratic presidential candidate Hillary Clinton have considered or proposed a national sovereign wealth fund to provide a guaranteed minimum income or a “citizen’s dividend”. However, Clinton noted that a resource-based fund would expose the country’s finite natural resources, particularly fossil fuels, to extensive exploitation which could be undesirable in the context of climate change or possible depletion. Trump’s executive order was signed in 2025 and has yet to be fully developed in scope.

In 1981, the Reagan administration advanced an agenda of significant tax cuts on the highest incomes. The Economic Recovery Tax Act of 1981 (ERTA) reduced the highest marginal tax rate from 70% to 50% and began the most significant wealth transfer from America’s working and middle classes to the top 1% of America’s wealthiest citizens.

- In 1870, at the start of the First Gilded Age, the top 1% controlled 27-28% of America’s total wealth while the bottom 50% controlled between 5% and 0%.

- By 1900, the wealthiest 1% controlled roughly 26% of America’s total wealth with the bottom 50% still controlling less than 5%.

- By 1989, the top 1% of Americans controlled 20% of America’s total wealth while the bottom 50% controlled 7%.

- In 2024, the top 1% now control 28% of America’s total wealth, while the bottom 50% control only 5.5%.

We have entered the Second Gilded Age. In Generation Z's lifetime, the richest have a bigger slice of a bigger pie, while most folks have fewer crumbs.

Due to this dramatic increase in wealth inequality, achieving the American Dream has become even more difficult, if not impossible, for most of America. In 2010, during the recovery from the Great Recession, some political candidates began to advocate for “Universal Basic Income”. The inability to readily access the American Dream lends a real sense of urgency to the current discussion of guaranteed minimum income.

In 2019, inspired by Martin Luther King’s views on GMI, mayor Michael Tubbs, in partnership with the Economic Security Project, launched the $3 million privately-funded Stockton Economic Empowerment Demonstration. It provided 125 residents with $500 per month in unconditional cash payments for two years. Similarly, GiveDirectly, the largest cash transfer non-governmental organization in the US, has overseen cash transfers of $270 million since 2017.

During the election cycle of 2020, some candidates again proposed a “universal basic income”, in anticipation of the reduction in available jobs due to automation and artificial intelligence (AI). These efforts use voluntarily contributed wealth to fund studies that have supported the positive economic outcomes of a GMI.

Wealth has never been in short supply in America. Americans are willing to work hard to provide for their families. Yet as we saw in the First Gilded Age, the 1950 and 60s, and here in the Second Gilded Age, a large part of that wealth stays in the pockets of a few, while about one American in five has no emergency savings. Guaranteed Minimum Income could address that inequality and create opportunity for all Americans.

Continue to Part 4 – The Future of GMI

Part I (1791 - 1945) • Part II (1946 - 1975) • Part III (1976 - 2025)

Works Referenced

Brown, William S., and Clive S. Thomas. “The Alaska Permanent Fund: Good Sense or Political Expediency?” Challenge, vol. 37, no. 5, 1994, pp. 38–44. JSTOR, http://www.jstor.org/stable/40721557. Accessed 14 May 2025.

Foster, Natalie. The Guarantee: Inside the Fight for America’s Next Economy. The New Press, 2024.

Piketty, Thomas, and Emmanuel Saez. “Inequality in the Long Run.” Science, vol. 344, no. 6186, 2014, pp. 838–43. JSTOR, http://www.jstor.org/stable/24743922. Accessed 18 May 2025.

Rosenbloom, Joshua L, and Gregory W Stutes. “Reexamining the Distribution of Wealth in 1870.” National Bureau of Economic Research Working Paper Series, No. 11482, July 2005, https://doi.org/10.3386/w11482.

Scola, Nancy. “Is Andrew Yang for Real?” Politico. May 20, 2019, https://www.politico.com/magazine/story/2019/05/20/andrew-yang-2020-226931/.

Williamson, Jeffrey G., and Peter H Lindert. “Long-Term Trends in American Wealth Inequality.” Modeling the Distribution and Intergenerational Transmission of Wealth, edited by James D. Smith, University of Chicago Press, 1980, pp. 9-94. https://www.nber.org/books-and-chapters/modeling-distribution-and-intergenerational-transmission-wealth/long-term-trends-american-wealth-inequality.

Yglesias, Matthew. “The big idea that could make democratic socialism a reality: An ambitious proposal to create an Alaska-style social wealth fund that could transform the global economy.” Vox. Aug 28, 2018, 7:10 AM MDT, https://www.vox.com/2018/8/28/17774334/social-wealth-fund-bruenig-solidarity.

“The Fed - Distribution: Distribution of Household Wealth in the U.S. since 1989.” DFA: Distributional Financial Accounts, Board of Governors of the Federal Reserve System, 21 Mar. 2025, www.federalreserve.gov/releases/z1/dataviz/dfa/distribute/chart/#range:1989.3,2024.4;quarter:141;series:Assets;demographic:networth;population:all;units:levels.

A Plan For Establishing A United States Sovereign Wealth Fund. The White House, February 3, 2025, https://www.whitehouse.gov/presidential-actions/2025/02/a-plan-for-establishing-a-united-states-sovereign-wealt